Understanding Home Replacement Cost and How It Affects Insurance Premiums

Home insurance is based on the cost to rebuild and replace your home, not its market value.

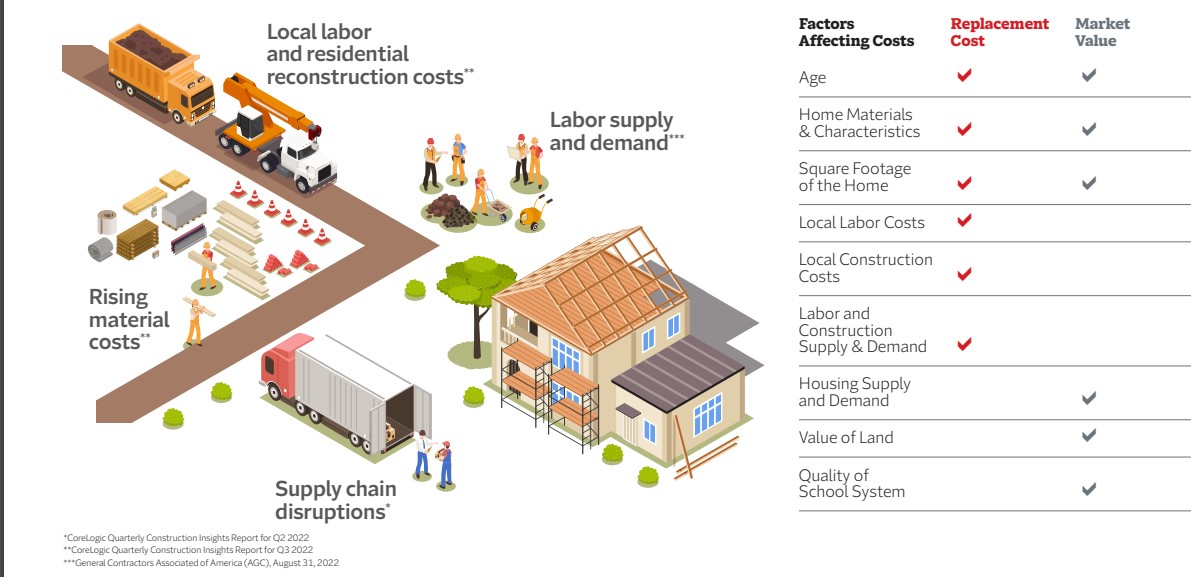

While market value is the amount your home is worth on the housing market, your home insurance coverage limit is based on the estimated cost to rebuild your home: the cost to repair, rebuild or replace what you had before, using materials of similar type and quality.

There are several current factors causing replacement costs to increase, which can affect your insurance premium.

Frequently asked questions about replacement cost

What is replacement cost?

Replacement cost is the amount it would take to repair, replace, or rebuild your home at current prices of construction materials and labor. When you insure your home for its estimated replacement cost, you help to ensure you have the coverage you need to repair or rebuild if it is damaged by a covered loss.

What is market value?

Market value is the amount your home is worth on the housing market.

Why is the coverage limit of my home higher or lower than the home’s market value?

Your home insurance amounts are based on its estimated replacement cost, or the cost to rebuild, and not the amount it would sell for on the housing market.

Why do insurance carriers review coverage limits annually and make adjustments to coverage limits?

Insurance carriers want to help you rebuild and replace what you had before. Coverage limits are reviewed annually and estimated using a number of factors. Depending on market conditions and any upgrades you may have made, coverage amounts may need to be adjusted.

Why are many policyholders seeing increases in their coverage limits in 2022?

Coverage limits need to keep up with rising inflation. This is an industry-wide issue. As mentioned above, many factors are considered when estimating your coverage. One of these factors is reconstruction costs. Reconstruction costs have risen steadily since our last assessment.

We’re Here to Help

There are a variety of factors to consider to make sure your home is properly insured. Our team at Dowd Insurance Agency is here to walk you through your homeowners policy and help you secure ultimate insurance protection for your personalized risks—ensuring full coverage in the event of a claim. Contact us today to review your policy or start a FREE quote online.

*Content originally made available by Travelers.

Tags: FAQs, Home Insurance